What’s next for US home prices?

What’s next for US home prices?

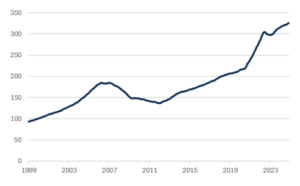

The Case-Shiller Home Price index, which measures price trends for single-family homes across the US, continues to reach new highs (Fig. 1). While the eye-popping year-over-year appreciation numbers have moderated (Fig. 2), there’s little indication that prices are about to head down.

Fig. 1: Case Shiller Home Price Index

Source: Bloomberg, Mill Creek.

Fig 2: Case Shiller Home Price Index, annualized change

Source: Bloomberg, Mill Creek.

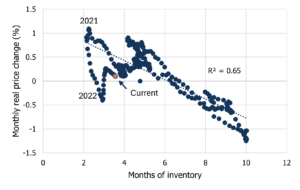

We monitor month-of-inventory as a good indicator of the supply-demand dynamic in single-family housing. Months-of-inventory considers the current inventory of homes for sale as well as the volume of transactions in the market and is a measure of the amount of time it would take to clear the current for sale inventory at current volume trends.

Home prices tend to appreciate, in inflation-adjusted terms, when months of inventory is below six months. We’re currently just above three months of inventory (Fig. 3). While affordability continues to weigh on housing, we’re unlikely to see a meaningful nationwide price downturn unless inventory picks up or transaction volume, which remains subdued, drops further.

Fig 3: Months-of-inventory and monthly price changes, 12-month rolling average

Source: Bloomberg, Mill Creek.

Disclosures & Important Information

Any views expressed above represent the opinions of Mill Creek Capital Advisers ("MCCA") and are not intended as a forecast or guarantee of future results. This information is for educational purposes only. It is not intended to provide, and should not be relied upon for, particular investment advice. This publication has been prepared by MCCA. The publication is provided for information purposes only. The information contained in this publication has been obtained from sources that

MCCA believes to be reliable, but MCCA does not represent or warrant that it is accurate or complete. The views in this publication are those of MCCA and are subject to change, and MCCA has no obligation to update its opinions or the information in this publication. While MCCA has obtained information believed to be reliable, MCCA, nor any of their respective officers, partners, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this publication or its contents.

© 2025 All rights reserved. Trademarks “Mill Creek,” “Mill Creek Capital” and “Mill Creek Capital Advisors” are the exclusive property of Mill Creek Capital Advisors, LLC, are registered in the U.S. Patent and Trademark Office, and may not be used without written permission.